- In January-November 2025, steel mill profits experienced a comprehensive recovery.

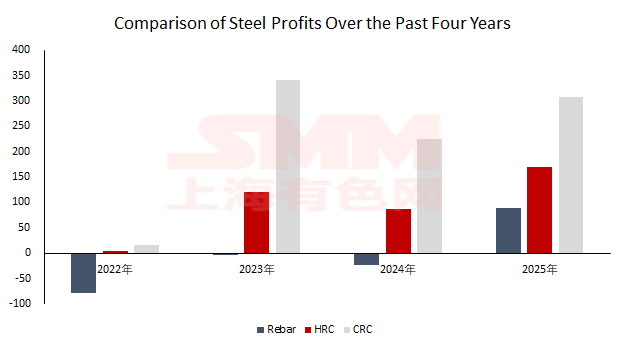

In 2025, steel mill profits saw significant improvement. According to SMM data, as of November 27, the average spot profit for rebar at blast furnace steel mills in east China was 90 yuan/mt, for hot-rolled coil was 170 yuan/mt, and for cold-rolled sheet was 308 yuan/mt, with an average profit of 189 yuan/mt across the three products. In comparison, the average was 96 yuan/mt in 2024, 152 yuan/mt in 2023, and even -19 yuan/mt in 2022. It is evident that compared to the period from 2022 to 2024, steel mill profits this year have achieved a full recovery.

The underlying reason is primarily due to the fact that since the beginning of this year, the decline in prices of raw materials such as iron ore, coal coke, and steel scrap has been greater than that of steel products. Influenced by factors such as ample supply and demand falling short of expectations, the average price of the 62% iron ore port spot index in 2025 fell by 7.0%, the average price of metallurgical coke decreased by 25.9% YoY, and the average price of steel scrap dropped by 10% YoY, leading to an 11% YoY decline in the average cost for steel mills. Although finished steel products were also affected by oversupply, resulting in price weakness, the decline in steel prices was slightly smaller than the drop in costs, thanks to the diversion of domestic surplus capacity by exports and demand support from the manufacturing sector. The price of mainstream specification hot-rolled coil in the Shanghai market fell by 8.3% compared to the previous year, the price of mainstream specification cold-rolled products in the Shanghai market decreased by 7.3% YoY, and the price of mainstream specification rebar in the Hangzhou market declined by 8.4% YoY. As the decline in raw material prices exceeded that of steel prices, steel mill profits were able to recover in 2025.

- Steel mill profits narrowed in November, expected to recover MoM in December.

Looking back at November, raw material side, iron ore prices rose slightly. Amid strict environmental protection inspections in multiple regions and tight supply, coke prices increased further, while steel scrap prices dropped slightly. Overall, steel mill costs rose 2.3% on average in November.

Finished products side, entering the off-season, steel demand weakened seasonally in November, coupled with a lack of macro stimulus. Steel prices fell first then rose, with the average price down 0.6%. Overall, steel mill profits deteriorated in November: hot-rolled coil profits dropped from around 103 yuan to 1 yuan, rebar profits fell from -8 yuan to -84 yuan, and cold-rolled profits declined from 216 yuan to 126 yuan.

In December, raw material side, multiple steel mills recently announced year-end maintenance plans, and hot metal production is expected to have further room for a pullback, with rigid demand weakening, putting further upward pressure on raw material prices under pressure. Finished products side, considering that two major domestic important meetings are scheduled to take place in December, coupled with increased probability of US Fed interest rate cuts, macro expectations are warming up. Additionally, against the backdrop of increased steel mill maintenance, easing supply pressure is expected to drive continued inventory drawdown. With macro tailwinds and relatively low fundamental risks, steel prices have some upside potential. Steel prices are expected to perform slightly stronger than raw material prices in December, and steel mill profits may see a slight recovery.

![[SMM Steel] India emerges as net exporter of finished steel in Apr-Feb FY26](https://imgqn.smm.cn/usercenter/UqlZJ20251217171717.jpg)

![[Domestic Iron Ore Commentary] Iron Ore Concentrates Prices in the Tangshan Area May Have Some Upside Potential](https://imgqn.smm.cn/usercenter/HbWNv20251217171718.jpg)